25PercentPermonth

Unlike other trade services that shoot for 5% returns while risking 100% of the account value, we risk much less of the account value while looking at returns 25-30% over a 2-week period and with possible returns of over 50% in a month. Losses can also be expected but we are strategizing to limit the size and scope of those losses. The stock market goes up and down but more often up. We’re using our system to take advantage of the upward drift or bias with our strategies, meanwhile, we incorporating a hedge protecting against some of the downside.

ABOUT US

Trade Experience

With over 2 decades of stock and options trading experience, we have developed a system to make consistent returns by utilizing credit and debit spreads.

Consistency

We’re putting our money where our mouth is so to speak. We are using these trades for our accounts, in addition backtested results and current trades validate our strategy.

Program performance

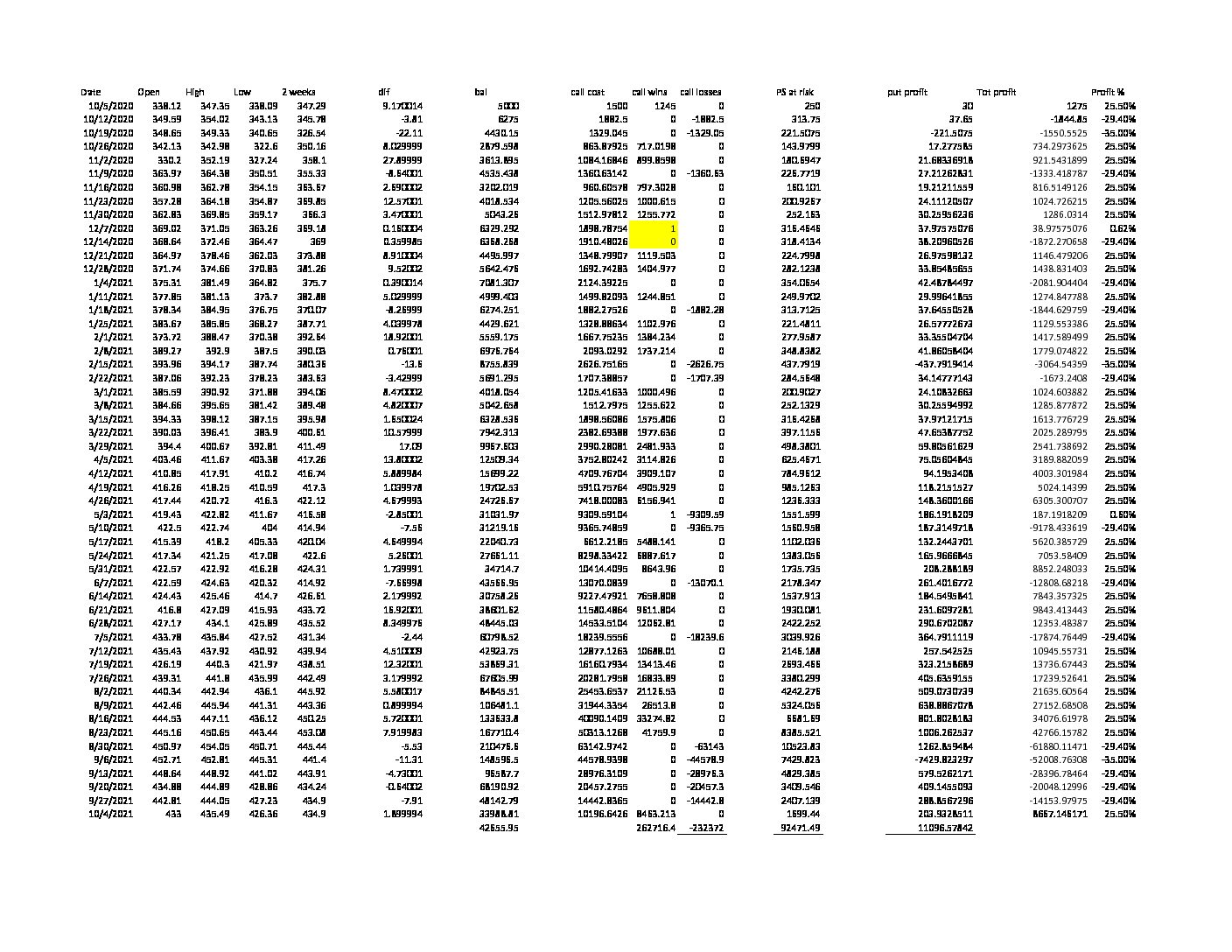

Backtested performance. Commission not accounted for in trades

…… = trades adjusted for change $37655.95 1 year account value /$5000 original investment = 763%

Actual Trades delayed data

| Underlying | Sold/Bought | Strategy | Strike/Date | Credit/Debit | Max at risk Result | Result Trade | ROI Capital Allocated |

|---|---|---|---|---|---|---|---|

| USO | Bought | Bill collector | Sell May 20 83 put Buy Jun 24 83 Put Roll Sample | $(3.50) | $350 | In Process | |

| Spy | Sold | Bill Collector | 445/446 Exp Nov 5 | $9 | $91 | Expired for full profit | 10% |

| Spy | Bought | Leaping Arrow | 460/461 Exp Nov 12 | ($0.59) | 0.59 | 2 profitable closes | 40% |

| Spy | Sold | Bill Collector | 451/450 Exp Nov 12 | $12 | $88 | Expired for full profit | 14% |

| SPX | Sold | Bill Collector | 4605/4600 Ex Nov 19 | $60 | $440 | Expired for full profit | 14% |

| Spy | Bought | Leaping Arrow | 468/469 Exp Nov 26 | (0.57) | 0.57 | Loss NewCovig Selloff | -100% |

| SPX | Sold | Bill Collector | 4690/4685 Ex Nov 26 | $60 | $440 | Expired for Full Profit | 14% |

| SPX | Sold | Bill Collector | 4605/4600 Dec 3 | $55 | $445 | Loss Omnicron Fears | -100% |

| Spy | Bought | Leaping Arrow | 468/469 Dec 23 | $56 | $56 | 1/2 exc .99 1/2 exp 1.00 | 74% |

| SPX | Sold | Bill Collector | 4480/4475 Dec 23 | $65 | $435 | Expired for Full Profit | 15% |

| SPX | Sold | Bill Collector | 4470/4475 Dec 23 | $70 | $430 | Expired for Full Profit | 16% |

| SPX | Sold | Bill Collector | 4350/4345 Dec 31 | $60 | $440 | Expired for Full Profit | 14% |

| Spy | Bought | Leaping Arrow | 477/478 Jan 1st | (.58) | .58 | Loss | -100% |

| SPX | Sold | Bill Collector | 4700/4695 | $55 | $445 | Loss Stop Reached | -28% |

successful trading with a PROVEN STRATEGY.

Options trading system

Automated trading system

Thinkorswim autotrade robot

Autotrading program

Tradewise autotrade

Autotrading robots

Weekly stock trading system

Options algorithmic trading

Frequently asked Questions FAQ’s

How many trades are made?

We have 2 strategies the Leaping Arrow the Bill Collector and they are included in your membership. We trade both and they work well together. You can open an account at one of our partner brokers or simply buy the signals.

How will I receive notice of trade?

Brokerage account information:

you will need a brokerage account with a level 3 options ability.

Can I lose money?

Yes but most of our trades are winning trades when we have a loss trade we utilize 2 trading strategies to add for diversification. What this does is not eliminate losses but this helps to greatly reduce the chances of having consecutive losses.

How much should I trade with?

This is completely up to you. Of our funds we have allocated to this trading plan, currently we trade with 40% of our account on the Leaping Arrow, 20% of our Bill Collector. We Leave all the rest of your funds in cash for protection against a market downturn. You should never trade with money you may need to use or spend coming up in the near future.

I still don't understand how to place the trades please help?

What type of brokerage should I use?

How much is your trade service?

$249.97 per month you will receive all signals include Trade Entry and trade exit.

***A Important notice on Allocations***

It is important to note we are not financial advisors or money managers. We do not give individual advice on money management. We only provide signal services and utilize the same strategy as the signals we are providing. Now with that being said losses happen and we have calculated there would be losses in this strategy be sure to limit the amount invested to a recoverable amount. Additionally, don’t be the gambler who won a million dollars and sat at the table and gambled it all away. If you have some good wins take some money out of the account and spend it or use it for something else.

How do I cancel my subscription?

Send us a formal email one week in advance of membership cancel date.

Services

TRADING EXPERIENCE

Over 25 years of valuable trading experience

ROUTINE TRADES

Bi Weekly trade goals, targeting 25% return each time.

TRADE MANAGEMENT

Constant supervision of open trades to maximize gains and minimize losses.

WEEKLY UPDATES

Weekly updates on performance

AUTOTRADING

Link with participating brokers to have them automatically submit trades for you. More…

CUSTOMER SUPPORT

Unlimited e-mail support and unfettered access to our privileged Member’s Area.

Are you ready to become a member